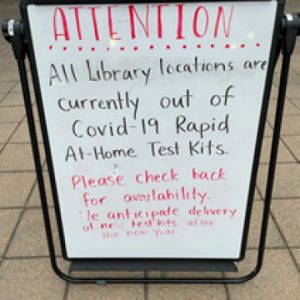

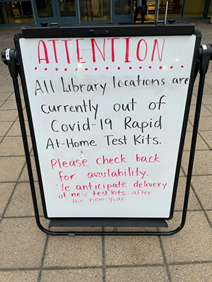

As we approach our third year of COVID, one of the major questions from March 2020 eerily echoes today: where are all the COVID tests? The situation now, of course, is very different and much more favorable than two years ago. Unlike March 2020, numerous tests by multiple manufacturers have been reviewed by FDA and are being distributed. There is also a wide variety of tests, including PCR assays, antigen tests, and antibody tests, and at least 16 over-the-counter assays (4 of which were authorized in the past month). And yet, there is still a dramatic shortfall in the number of tests available. There are innumerable accounts of desperate scavenger hunts for a COVID assay (link), and a photograph taken by one of us (Jeff) at the local library depicts an all too common scene.

There are multiple explanations for the current inadequate number of tests (link), including government policies on test procurement, manufacturers’ decisions to curtail production when demand fell this summer, the extraordinarily rapid spread of the omicron variant, and surges in demand brought on by the holidays. But while the advent of omicron unquestionably precipitated the immediate critical shortage, limitations on the availability of COVID tests in the United States was a vulnerability long before the emergence of this variant (link). As we chronicle in an article that appears in the current edition of the Food and Drug Law Journal, FDA’s policies for reviewing COVID assays, have been a contributing factor.

Over the past two years, FDA has played a central role as gatekeeper for COVID tests. This role is one that has sporadically received attention (link) but which has not undergone a detailed analysis. To help fill that void, our article takes an in-depth look at FDA’s policies since the emergence of the pandemic in the United States. This article (link), which is made available with the permission of the Food and Drug Law Institute, examines multiple facets of FDA’s regulation of COVID assays.

The onset of COVID brought unprecedented challenges to FDA. There is no question that the agency has devoted herculean efforts and resources to reviewing and authorizing COVID assays. As of the latest count, FDA has granted more than 420 Emergency Use Authorizations (EUAs) for COVID In Vitro Diagnostics (IVDs) (25 of which were laboratory developed tests). And that total understates the agency’s efforts to address the critical need for testing, which have included holding 75 Town Hall meetings and issuing eight EUA submission templates.

At the same time, as our article discusses, the agency has taken steps that have unnecessarily impeded the introduction of assays. For example, the agency has abruptly changed its policies, leaving numerous tests in regulatory limbo and unavailable for use. The agency’s prioritization scheme has been opaque and confusing, and its implementation has kept COVID tests off the market and hampered decision-making by IVD companies. The strict data requirements for tests intended to be used with asymptomatic patients led to a lack of tests available for that use. Ultimately, FDA took the unprecedented step of affirmatively encouraging the off-label use of tests authorized for symptomatic patients to be used off-label for asymptomatic patients. As we learned first-hand through our counseling of scores of companies, and as has been reported in the media (link), the unpredictability of FDA policies had a chilling effect on product development and submissions.

FDA’s approach to laboratory developed tests (LDTs) has been perhaps one of the most remarkable examples of the impact of agency regulation on test development and availability). As we’ve blogged about on many occasions (see, e.g., link, link, link, link), FDA’s LDT policy has been fraught for decades, and the consequences of unresolved jurisdictional issues were made manifest during the pandemic.

As we describe in the article, at the outset of the pandemic FDA blocked labs from offering COVID LDTs without an EUA, choosing instead to rely solely on the CDC’s assay. When that assay turned out to be flawed (link), there were no alternate laboratory tests available because labs had been discouraged from developing them. Only after weeks of the country flying blind in the face of the viral onslaught did FDA permit labs to offer testing while they prepared EUA requests for submission. In August 2020, the Department of Health and Human Services intervened, directing FDA to stop requiring EUAs for LDTs in the absence of rulemaking. This policy was reversed in November 2021, and laboratories were given 60 days to submit EUA requests (the deadline is January 14th) (link). Given the inadequate testing capacity and the surging demand in the United States, it is inexplicable that FDA would take any steps that could increase burdens on test developers and potentially reduce test availability without an extraordinary reason – which FDA did not offer.

Our article closes with a strong recommendation that FDA take a close look at what has gone well with its review of COVID IVDs – and a lot has – and where improvements are needed. Mistakes cannot be glossed over. Under FDA’s quality system requirements, device manufacturers must review all available sources of information to identify quality problems, institute meaningful corrective and preventative actions when appropriate, and then verify effectiveness. We should expect no less from FDA itself when it comes to self-evaluation of the impact of its testing policies on pandemic preparedness.

In the past few decades, multiple new and deadly etiologic agents have arisen. SARS-CoV-19 will not be the last one. The next time, the United States – and FDA – need to be much better prepared to facilitate widespread testing.

* In recognition of the wide and eclectic musical tastes of our HPM Blog followers, this blog post title alludes to the music of both Pete Seeger and Taylor Swift.

The authors acknowledge and thank Charlie Snow for his assistance in preparing this blog post.